Live Enough? How Up to Date Should My QuickBooks Be?

Running a small business comes with many responsibilities, and one of the most critical is maintaining accurate bookkeeping. Without proper financial records, you risk making poor business decisions, facing cash flow problems, or even running into issues with the IRS. But often with my freelance QuickBooks services, I find my clients may struggle to understand the inherent “lag” that comes with with bookkeeping for small businesses.

So, in this blog, we’ll answer two common bookkeeping questions:

How up to date should my bookkeeping be?

Why doesn’t my QuickBooks balance match my bank or credit card balance?

We’ll also explain key bookkeeping concepts, including:

The difference between posted and unposted transactions in QuickBooks

The importance of monthly closing

By the end, you’ll have a clearer understanding of how to keep your books accurate and avoid common financial pitfalls.

1. How Up to Date Should My Bookkeeping Be? Suggestions for Best Bookkeeping for Small Businesses

More up to date is always better, but setting a realistic goal for timeliness partly depends on your business. Your bookkeeping should stay reasonably current, but it’s normal for small businesses to work a few weeks behind. Larger organizations may even work a couple months behind. This means that in some companies, the bookkeeping for July is being done in September, and August in October, and so on.

Why Timeliness Matters

Cash Flow Visibility – Falling too far behind means you might miss warning signs of financial trouble. The tighter the cash flow within a company, the more current the books ought to be. This is especially true before incurring large expenses such as biweekly payroll.

Tax Compliance – Catching up right before tax season increases errors and stress.

Informed Decisions – The more up to date your books, the better your financial choices.

Realistic Practices for Best Bookkeeping for Small Businesses

Weekly or Biweekly Updates – There may be certain tasks that are best done on a daily basis within QuickBooks. But many bookkeeping tasks are fine to do on a weekly or even biweekly basis. Personally, I at least check on all my clients books at least once a week, and will usually find time to update them that same week.

Monthly Reconciliation – Matching QuickBooks with bank statements monthly prevents major discrepancies.

Batch Processing – Some businesses enter transactions in batches rather than in real time.

Key Takeaway: It’s okay if your books aren’t perfectly up to the minute—what matters is consistency.

2. Why Doesn’t My QuickBooks Balance Match My Bank or Credit Card?

This is completely normal—your QuickBooks balance and bank balance will rarely match on any given day, and that’s expected. Here’s why:

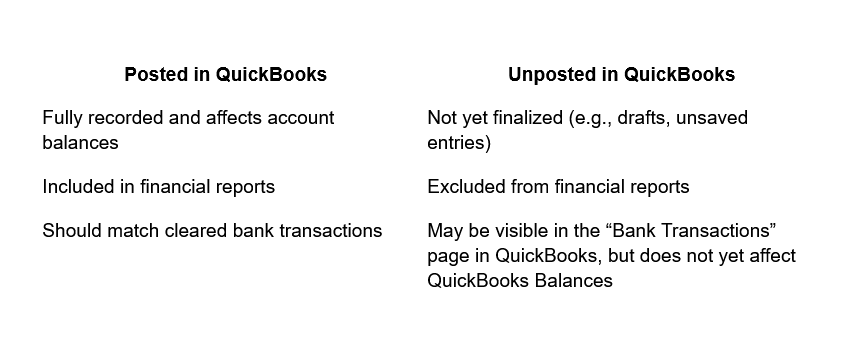

A. QuickBooks Posted vs. Unposted Transactions

Posted Transactions in QuickBooks – These are fully recorded and affect your account balances.

Unposted Transactions in QuickBooks – These may exist as drafts, pending entries, or unapproved transactions and do not yet impact your balance.

B. Bank Processing Delays

Pending Transactions – Credit card purchases or checks may take days or weeks to clear.

Bank Holds & Deposits – Some deposits (like checks) may not be immediately available.

Bank Fees & Adjustments – Your bank may deduct fees that aren’t yet recorded in QuickBooks.

3. What Should I Do to Keep My Books Current?

Many businesses reconcile weeks or even months retroactively, meaning QuickBooks won’t match the bank’s current balance until reconciliation happens. Don’t panic—this is normal. As for what to do:

Regularly categorize transactions from your QuickBooks bank feed.

Enter bills you receive as soon as you get them, or at least set up a time weekly to enter bills into QuickBooks.

Reconcile and close the books monthly (more on that below).

Set a deadline for monthly closings and try to meet it consistently.

Establish effective and quick means of communication. If, for example, bills are only picked up from the post office once a week, and then mailed to a bookkeeper a week later, then by the time a bookkeeper actually receives the bill and has time to enter it into QuickBooks, three or four weeks may have passed from the time it arrived in the mail.

Use faster, digital means of communication where possible. And be consistent in sending documents and information in a timely manner.

4. The Importance of Monthly Closing - Finalize Your Income Statement!

Monthly closing finalizes your books for the month. Since most businesses work retroactively, this process ensures:

Accurate Financials – Reliable reports for decision-making.

Easier Tax Filing – No year-end scramble.

Fraud Detection – Unusual transactions stand out when reviewed monthly.

Steps in Monthly Closing

Reconcile All Accounts – Bank, credit cards, loans.

Review the Trial Balance – More on this below!

Make Adjusting Entries – Depreciation, accrued expenses.

Generate Financial Statements – Profit & Loss (Income Statement), Balance Sheet.

Archive & Back Up – Protect your data.

5. The Trial Balance: A Foundational Bookkeeping Concept

The trial balance is one of the most fundamental concepts in traditional bookkeeping, serving as a critical checkpoint to ensure a company’s books are mathematically accurate. Historically, bookkeepers and accountants would prepare a trial balance at the end of an accounting period—typically monthly, quarterly, or annually—by listing every general ledger account and its debit or credit balance. The primary rule? Total debits must equal total credits. If they didn’t, it signaled errors such as misclassified transactions, duplicate entries, or omitted postings, requiring investigation before financial statements could be finalized.

In today’s digital age, however, platforms like QuickBooks Online (QBO) automate much of this process, making the traditional trial balance less visible—though no less important. While QBO doesn’t prominently display a classic trial balance report (preferring instead to highlight real-time summaries like the "Balance Sheet" and "Profit & Loss"), the underlying principle remains vital.

When closing the books at month-end, businesses still need to ensure their general ledger balances are correct. If discrepancies arise—say, from unreconciled transactions or incorrect journal entries—the solution often involves manual adjustments to bring things into balance. For example, if bank fees were missed, a manual journal entry would debit expenses and credit cash to align QBO with the bank statement. Understanding this process empowers bookkeepers to troubleshoot discrepancies and maintain accuracy, even when the software obscures the trial balance’s traditional form.

In essence, while QuickBooks Online streamlines bookkeeping, the trial balance’s logic persists. Recognizing its role helps business owners verify their financial data’s integrity, particularly when reconciling accounts or closing the books at a specific cutoff date. Whether done manually in spreadsheets or managed implicitly by software, balancing the books remains a non-negotiable pillar of sound financial management.

Final Thoughts

QuickBooks and bank balances will rarely match daily—this is normal due to pending transactions and reconciliation timing.

Many businesses work weeks or months behind—consistency matters more than real-time updates.

Posted vs. unposted transactions in QuickBooks explain some discrepancies.

Monthly reconciliation and closing keep your books accurate.

If bookkeeping feels overwhelming, consider hiring a bookkeeper! Trust me, your CPA will thank you. Staying on top of your finances—even if not in real time—saves stress and prevents costly mistakes.

Need help catching up on bookkeeping? Click here to contact us for a consultation!