How to Read and Understand Your Profit & Loss Statement (Income Statement): A Guide for Small Business Owners

As a small business owner, understanding your financial statements is crucial for making informed decisions. One of the most important reports you’ll encounter is the Profit & Loss Statement (P&L), also known as the Income Statement.

This document tells you whether your business is making money or losing it—and where those profits or losses are coming from. Yet, many entrepreneurs glance at the bottom line (net profit) without fully grasping what the numbers mean.

As a freelance bookkeeper trying to offer the best bookkeeping for small businesses, I review my clients income statements on a regular basis. But I also want to ensure that they are educated on how to review and understand these statements themselves. So in this guide, we’ll break down:

✔ What a P&L statement is and why it matters

✔ Key terms and sections explained in plain language

✔ How to analyze your P&L to improve profitability

✔ A real-world example to tie it all together

By the end, you’ll be able to read your P&L with confidence and use it to make smarter financial decisions.

What Is a Profit & Loss Statement (Income Statement)?

A Profit & Loss Statement summarizes your business’s revenues, costs, and expenses over a specific period (monthly, quarterly, or annually). It answers the fundamental question:

"Is my business profitable?"

Unlike a balance sheet (which shows your financial position at a single point in time), the P&L tracks performance over time. It’s essential for:

Tracking profitability – Are sales covering expenses?

Identifying trends – Are costs rising faster than revenue?

Securing financing – Lenders and investors will review your P&L.

Tax preparation – Helps determine taxable income.

Key Components of a P&L Statement

A standard P&L follows this structure:

1. Revenue (Sales or Income)

This is the total money earned from selling goods or services before any expenses are deducted. It may be broken down into:

Gross Revenue – Total sales without deductions.

Net Revenue – Sales minus returns, discounts, or allowances.

Example:

If your bakery sold $50,000 in cupcakes but had $2,000 in refunds, your net revenue is $48,000.

2. Cost of Goods Sold (COGS)

These are the direct costs of producing your product or service, such as:

Raw materials

Labor for production

Shipping and manufacturing costs

Formula:

Gross Profit = Revenue – COGS

Example:

If your cupcake business had $20,000 in ingredient and labor costs, your gross profit is:

$48,000 (Revenue) – $20,000 (COGS) = $28,000 Gross Profit

3. Operating Expenses (Overhead Costs)

These are the indirect costs of running your business, such as:

Rent & utilities

Salaries (non-production staff)

Marketing & advertising

Software subscriptions

Insurance

Example:

If your bakery spends $10,000/month on rent, salaries, and marketing, these are operating expenses.

4. Other Income & Expenses

This includes non-operational items like:

Interest income (from savings or investments)

Loan interest payments

One-time gains/losses (e.g., selling equipment)

How to Analyze Your P&L Statement

Now that you understand the components, let’s discuss how to interpret them:

1. Check Your Profit Margins

Gross Profit Margin = (Gross Profit / Revenue) × 100

Example: ($28,000 / $48,000) × 100 = 58.3%

Net Profit Margin = (Net Profit / Revenue) × 100

Example: ($16,500 / $48,000) × 100 = 34.4%

Why it matters:

A declining gross margin could mean rising production costs.

A low net margin suggests high overhead expenses.

2. Compare Periods (Month-over-Month or Year-over-Year)

Look for trends:

Are sales growing?

Are expenses increasing faster than revenue?

3. Identify Cost-Saving Opportunities

Are certain expenses (like marketing) not generating enough ROI?

Can you negotiate better supplier rates to lower COGS?

4. Benchmark Against Industry Averages

If your net margin is 10% but competitors average 20%, you may need to adjust pricing or costs.

Red Flags in Your Profit & Loss Statement

Even if your P&L shows a profit, certain line items can indicate errors, inefficiencies, or even fraud. One of the benefits of hiring a freelance bookkeeper is that they can spot these issues early, which can save you from financial headaches down the road.

Here are key red flags to watch for in your Profit & Loss Statement:

1. Unexplained or "Miscellaneous" Expenses

What it looks like: A large or recurring "Miscellaneous" category in expenses.

Why it’s a problem:

Proper bookkeeping should categorize every expense.

Vague labels make it hard to track spending and could hide errors or unauthorized purchases.

What to do:

Review receipts and reclassify transactions properly.

Set up clear expense categories (e.g., "Office Supplies," "Marketing").

2. Unusually High Cost of Goods Sold (COGS)

What it looks like:

COGS is higher than revenue (meaning you're losing money on every sale).

COGS fluctuates drastically without a clear reason (e.g., no change in product costs).

Why it’s a problem:

Could mean that certain expenses are incorrectly being counted multiple times (ie: once as a credit card purchase, once as a purchase of supplies).

May indicate theft or waste in production.

What to do:

Reconcile books against bank statements and credit card statements to ensure accuracy.

Check supplier invoices for accuracy.

3. Payroll That Doesn’t Match Staff Levels

What it looks like:

Payroll expenses spike unexpectedly without new hires.

Employee wages seem too high or too low for their roles.

Why it’s a problem:

Could signal duplicate payments, incorrect payroll taxes, or excessive use of overtime.

May mean misclassified workers (e.g., contractors listed as employees).

What to do:

Compare payroll reports with employee records.

Ensure proper tax withholdings and benefits deductions.

Examine the amount of overtime being paid and look for new hires or reducing total hours worked.

4. Negative Accounts

What it looks like:

When an expense account such as “Payroll Fees” is negative on your Profit and Loss report, that means you are actually making money from payroll fees. This would indicate some kind of error.

Similarly, if an income account such as “Sales” shows as negative, that means that you are losing money by making sales. Clearly something is wrong here.

Why it’s a problem:

Could be transactions miscategorized to the wrong account.

Could be that the chart of accounts hasn’t been set up correctly.

What to do:

Examine the chart of accounts for potential issues.

Check negative accounts for miscategorized transactions.

6. Monthly Fluctuations

What it looks like:

If you compare a few months of Profit and Loss Statements against each other, you should usually see similar values from month to month. If there is a significant change, it will usually occur gradually.

If the value of a monthly income or expense changes significantly from one month to another, or a value is outside of expected range, that should trigger an investigation.

If there is not a clear operational reason for the difference, there may be something wrong with the books. (ie: You landed a big new client contract last month, so sales will be higher than usual this month.)

Why it’s a problem:

This could indicate transactions that have been miscategorized.

It could also indicate that the wrong dates have been entered for certain transactions.

What to do:

Examine in detail any accounts with values outside of expectations. Try to find answers for what changed from one month to another.

If you are receiving and paying bills for multiple months all at once, you may want to accrue expenses ahead of time.

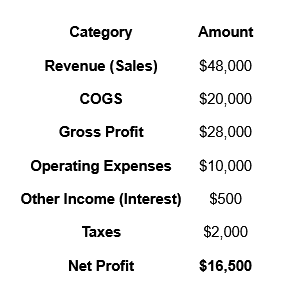

Real-World P&L Example: A Small Bakery

The best bookkeeping for small businesses can vary depending on the specific circumstances. So let’s apply what we’ve reviewed to a sample P&L for a hypothetical bakery:

Key Takeaways:

✔ The bakery is profitable, with a 34.4% net profit margin.

✔ COGS is 41.6% of revenue ($20,000/$48,000), which is maybe a little higher than most food businesses.

✔ If rent increases, operating expenses could eat into profits.

Next Steps: Using Your P&L to Improve Your Bookkeeping for Small Businesses

Review monthly – Catch financial issues early.

Adjust pricing or costs – If margins are shrinking, consider raising prices or cutting unnecessary expenses.

Forecast future performance – Use past P&Ls to predict cash flow.

Consult a freelance bookkeeper – We can help you clean up your Profit and Loss statement and alert you to any key changes.

Final Thoughts

Your Profit & Loss Statement is more than just a tax document—it’s a powerful tool for managing your business’s financial health. By understanding each section, you can:

✅ Track profitability

✅ Control costs

✅ Make data-driven decisions

If you need help setting up or interpreting your P&L, consider working with a professional bookkeeper (like us!) to ensure accuracy and maximize your financial success.

Need help with your bookkeeping? Contact us today for a free consultation!