Point of Sale Software vs. Accounting Software: Key Differences and Integration

In today’s fast-paced business environment, managing sales and finances efficiently is crucial. Many business owners rely on software solutions like Point of Sale (POS) systems (e.g., Square, Clover) and accounting software (e.g., QuickBooks Online) to streamline operations. While both types of software play essential roles, they serve different purposes.

This blog will explore:

The key differences between POS software and accounting software

The shortfalls of POS software in handling accounting tasks

How POS systems can integrate with accounting software like QuickBooks Online

By understanding these distinctions, businesses can optimize their workflows and avoid costly financial errors.

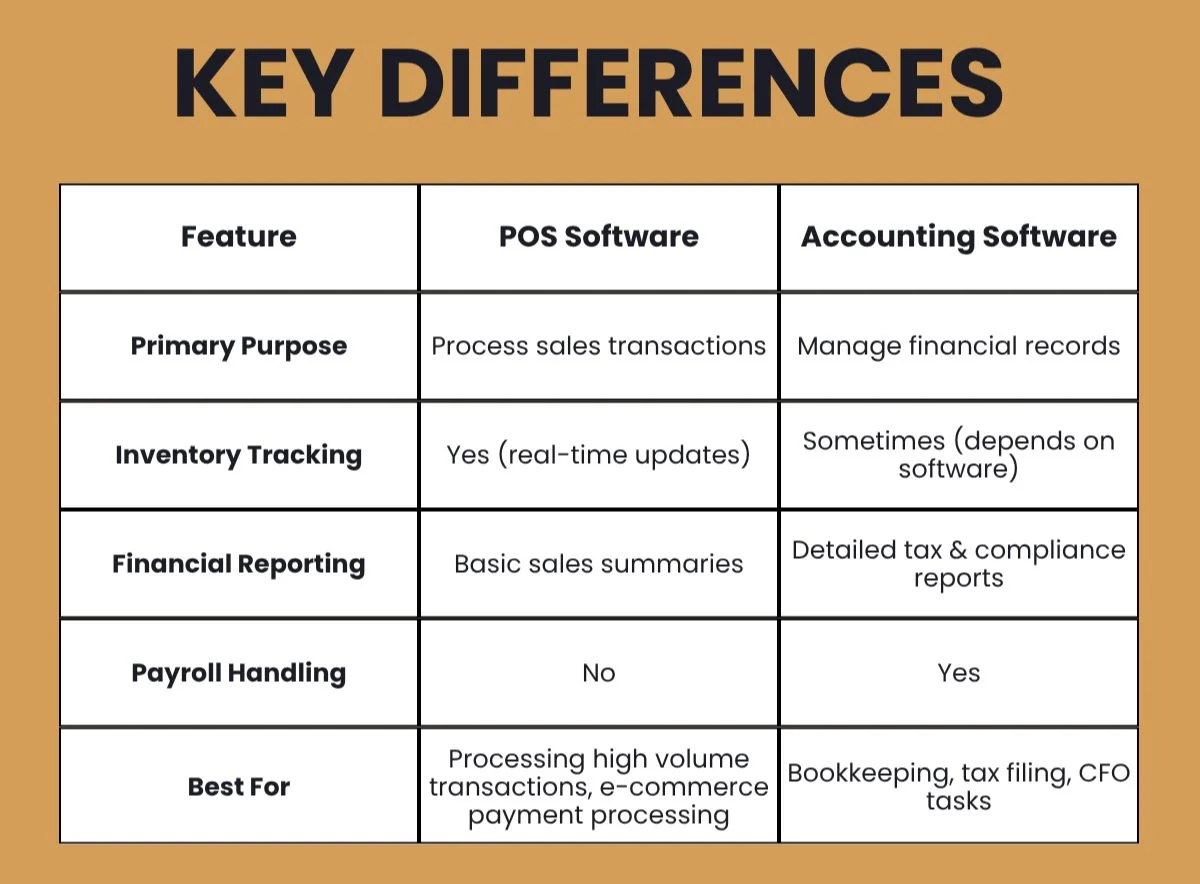

POS Software vs. Accounting Software: What’s the Difference?

What is Point of Sale (POS) Software?

POS software is designed to facilitate sales transactions. It helps businesses process payments, track inventory, and generate sales reports. Popular POS systems like Square, Clover, and Shopify POS are commonly used in retail stores, restaurants, and e-commerce businesses.

Key Features of POS Software:

Processes credit/debit card payments and cash transactions

Tracks inventory in real-time

Generates receipts and invoices

Manages customer loyalty programs

Provides basic sales analytics

What is Accounting Software?

Accounting software is built to manage financial records, track expenses, and generate tax-compliant reports. It helps businesses maintain accurate books for businesses. Some accounting software, such as QuickBooks Online, can integrate with payroll systems to handle employee payments.

Key Features of Accounting Software:

Records income and expenses

Manages accounts payable and receivable

Generates financial statements (P&L, balance sheets)

Handles payroll and tax calculations

Integrates with banks for automatic transaction imports

The Shortfalls of POS Software in Accounting

POS software simplifies sales processing, but relying on it for accounting can lead to problems:

A. Limited Financial Reporting

Most POS systems provide basic sales reports but lack more sophisticated reports like:

Profit & Loss (P&L) statements

Balance sheets

Cash flow analysis

Tax deduction tracking

Without these, businesses may struggle to assess profitability accurately.

B. No Double-Entry Bookkeeping

Accounting follows double-entry bookkeeping (every debit has a corresponding credit). POS systems typically use single-entry recording, which can lead to:

Discrepancies in financial records

Difficulty reconciling bank statements

Errors in tax filings

C. Poor Expense Tracking

POS software records sales but does not track business expenses like:

Vendor bills

Employee wages

Overhead costs

Without expense tracking, businesses can’t calculate net profit accurately.

D. Lack of Audit Trails

Accounting software maintains detailed logs for compliance. POS systems often lack:

Transaction histories with timestamps

User access logs

Revision tracking

This makes financial audits more difficult.

How POS Software Integrates with QuickBooks Online

Since POS and accounting software serve different purposes, integration bridges the gap to maximize efficiency. Most modern POS systems sync with QuickBooks Online, or other accounting platforms.

Benefits of Integration

Automated Data Entry: Sales, tips, and fees flow directly into accounting software, reducing manual errors.

Real-Time Financial Insights: Businesses see up-to-date revenue and expense data.

Better Inventory & Tax Tracking: Sync product sales recorded in your POS with cost of goods sold (COGS) recorded in QuickBooks for accurate profit margins.

Integration Options:

Direct Sync (Native Integration)

POS systems like Square, Clover, and Shopify offer built-in QuickBooks integration.

Transactions auto-populate in the correct accounts (e.g., sales, fees, tips).

Third-Party Connectors (Zapier, A2X)

If a POS lacks direct integration, tools like A2X for Shopify or Zapier can link systems.

CSV Import/Export

Some businesses export POS sales data and manually import it into QuickBooks. This is far less efficient than direct integration, but if you have a bookkeeper that knows how to format spread sheets for QuickBooks, it can be a viable option.

Integration is not without its challenges. Without a bookkeeper managing the integrated software, it is common to encounter problems such as:

Duplicate Entries: If not configured properly, sales may be recorded twice.

Misclassified Transactions: Fees or discounts might post to the wrong accounts.

Sync Delays: Some integrations update periodically, not in real-time.

Best practice is to regularly reconcile POS data with accounting records to catch discrepancies early.

Conclusion: POS and Accounting Software – Better Together

While POS software excels at processing sales and managing inventory, accounting software is essential for financial management, tax compliance, and business growth. Relying solely on a POS system for accounting can lead to reporting gaps, tax headaches, and cash flow blind spots.

The best solution? Use both systems together. By integrating your POS with accounting software like QuickBooks Online, you can:

✔ Automate bookkeeping and reduce errors

✔ Gain deeper financial insights with real-time reporting

✔ Simplify tax preparation with accurate records

If you're still managing sales and finances separately, it’s time to explore integration options—your future self (and your accountant) will thank you!

Need help setting up POS and accounting software? Consult with a bookkeeping professional to ensure seamless synchronization.